As a result of the U.S. Fifth Circuit’s ruling to vacate the SEC’s Private Fund Advisers (PFA) rules on June 3, the ILPA Quarterly Reporting Standards Initiative (QRSI) has evolved.

Most fundamentally, the basis for the QRSI effort has shifted from adherence to the SEC’s former requirements to delivering the next natural evolution of ILPA templates built on adoption, standardization and industry practices. This foundational shift has resulted in both specific changes to the updated templates shared to date and broad impacts to the initiative timeline as a whole.

Draft Template Changes: Pre-PFA to Post-PFA

Following the Fifth Circuit’s ruling, the QRSI team has worked quickly to adjust both the templates and the timeline, resulting in a new set of post-PFA template drafts that are more adoption-oriented. Initiative participants, including ILPA member LPs, GPs and other industry stakeholders, will continue to workshop the drafts ahead of the new comment period launch in August.

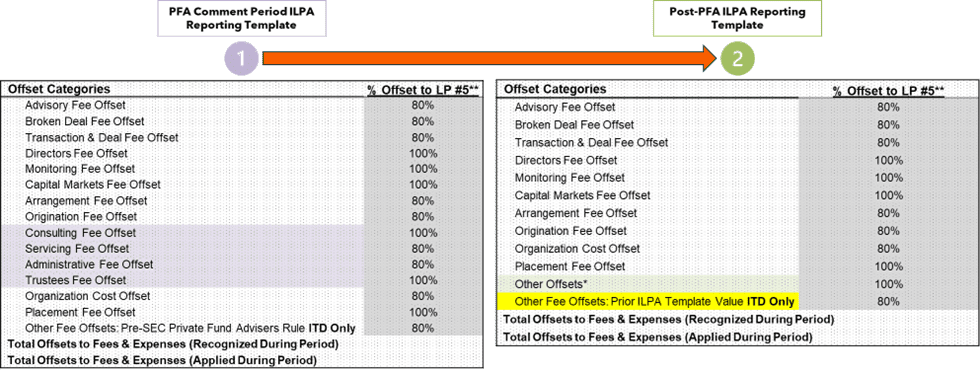

Extract of the ILPA Reporting Template’s post-PFA evolution

Extract of the ILPA Reporting Template’s post-PFA evolution

The QRSI team has begun adjustments to specific sections, such as the removal of the Sub-Adviser Fees rows, in addition to specific line items, such as the new and updated Partnership Expenses. Outside of specific line-item or template section updates, a number of key structural elements, such as delivery requirements, have already been assessed with the QRSI Working Groups. Such re-engagement will continue over the next few weeks in preparation for the comment period.

Industry Comment Period Coming soon

Originally launched on June 3, the new comment period is currently scheduled to kick off in early August. The six-week duration initially planned has also been extended to a new, ten-week period, allowing for even more feedback from throughout the industry. The current anticipated close date for the comment period will be in early October.

Following the comment period close, the QRSI team intends to roll out the full package of templates to the industry by late November or early December.

Additionally, given that the PFA rules have been vacated, the mandated implementation date of Q1 2025 no longer applies, and ILPA will not retain this aggressive deadline. The QRSI team is engaging with the Working Groups to identify a new, recommended implementation date, which will likely be either Q1 2026 or Q4 2025.

With regard to the implementation date, this will not apply to all active funds. Once determined in collaboration with the Working Groups, the QRSI team will provide an update as to which vintage year funds will be subject to this new, recommended implementation date.

Call for Engagement: Expanding the QRSI Satellite Groups

Given the new adoption-focused approach, and the extended timeline for additional feedback, engagement with organizations throughout the industry has become more important than ever.

We want your perspective. To join a Satellite Group, visit the QRS landing page to complete a short form.

Additionally, for those already supporting a Satellite Group, please reach out to your colleagues to join as well. We provide sample language on our QRSI site to assist in this ask.

Capturing the global perspective

One benefit stemming from the Fifth Circuit’s ruling includes greater flexibility to consider other standards when drafting the updated templates.

For QRSI participants outside of the U.S., this flexibility provides an opportunity for enhanced connectivity with IFRS and other international standards.

The QRSI team will pose questions on international standards as part of the comment period; the team welcomes any suggestions on incorporating key elements from international standards into the template drafts prior to the comment period as well, whether through Satellite Group participation or via email to quarterlyreporting@ilpa.org.

As planned from the onset of the initiative, ILPA will proceed with soliciting feedback during the comment period broadly across geographies.

Visit ilpa.org/quarterlyreporting to learn more and get involved.