Purposeful engagement with leading EMEA LPs

Our reimagined London-based flagship event, now the ILPA Forum EMEA, will take place at the Waldorf Hilton in London from 27–29 April 2026.

Centered on purposeful LP engagement, the Forum features LP-curated engagement, high-value networking opportunities, and in-depth discussions on the sector themes that matter most. The result is a focused, intentional experience that delivers meaningful value.

Reasons to Attend as a General Partner

How is the ILPA Forum EMEA experience different from other events?

ILPA Forum EMEA: Surpassing your event expectations! Expect the same high quality, efficient experience you have come to know and to count on for the better part of two decades!

- Purposeful access, driven by LP demand.

- A chance to align with today’s LP priorities.

- An intimate, high-signal environment.

- Flexible engagement options.

- A differentiated ILPA experience.

- An opportunity to support the evolution of the LP-GP partnership.

GP Application Process

ILPA Forum EMEA is shaping up to provide GPs like you with a high-quality, LP-curated engagement opportunity with leading EMEA-based LPs.

Applying & Eligibility

Based on attendee feedback, we’ve refined the LP–GP process to ensure more purposeful, high-value interactions. Below is what you need to know as you prepare to submit your application beginning 10 December 2025.

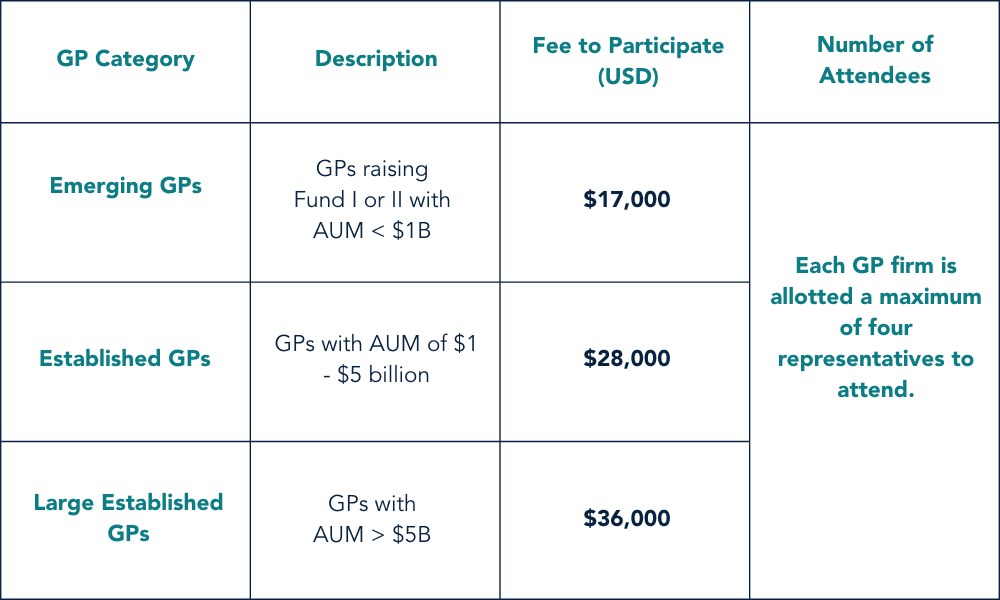

GPs must apply during the open application period (10 December 2025 –31 January 2026). LPs registered for the event will review all applications and decide which firms should be selected based on their strategic interests. The top-ranked 35 GPs across all tiers—Emerging Managers, Established Managers, and Large Established Managers—will be invited to participate. A detailed chart outlining GP registration pricing by tier is provided below.

- Meetings on Demand: LPs will initiate all meeting requests through the event app with the GPs that match their interests and strategy, replacing the mutual ranking process we’ve used at our London flagship event in the past. Our agenda will include four formal sessions for GPs to meet individually with LPs as part of the conference, with opportunities for additional meetings based on LP interest. Schedules are built entirely by LPs, ensuring every interaction is purposeful and value-driven.

- Event Access & Participation: Selected GPs may bring up to four firm representatives. All participants have access to content sessions starting mid-day on 28 April through the close of the event on 29 April. Programming includes deep dives into AI, secondaries, co-investments, retail capital, and key sector trends, giving GPs insight into the issues shaping European private markets.

- Networking & Shared Experiences: Beyond meetings, GPs can participate in interactive activities like a pub quiz, fitness sessions, and cocktail receptions, as well as informal gatherings designed to foster authentic connections with LPs and peers.

- Additional Benefits: GPs will receive a dedicated meeting room and a full conference attendee list with contact details at least one week before the event. Tiered registration allows firms to align participation with relationship goals and strategic priorities.

2025 GP Participants

* New to ILPA Summit Europe (Now ILPA Forum EMEA)

Need More Information About the ILPA Forum EMEA?

For any questions at this time, please email the Events team.