Capital Call And Distribution Notices

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

NOW LIVE: Capital Call & Distribution Template Public Comment Period

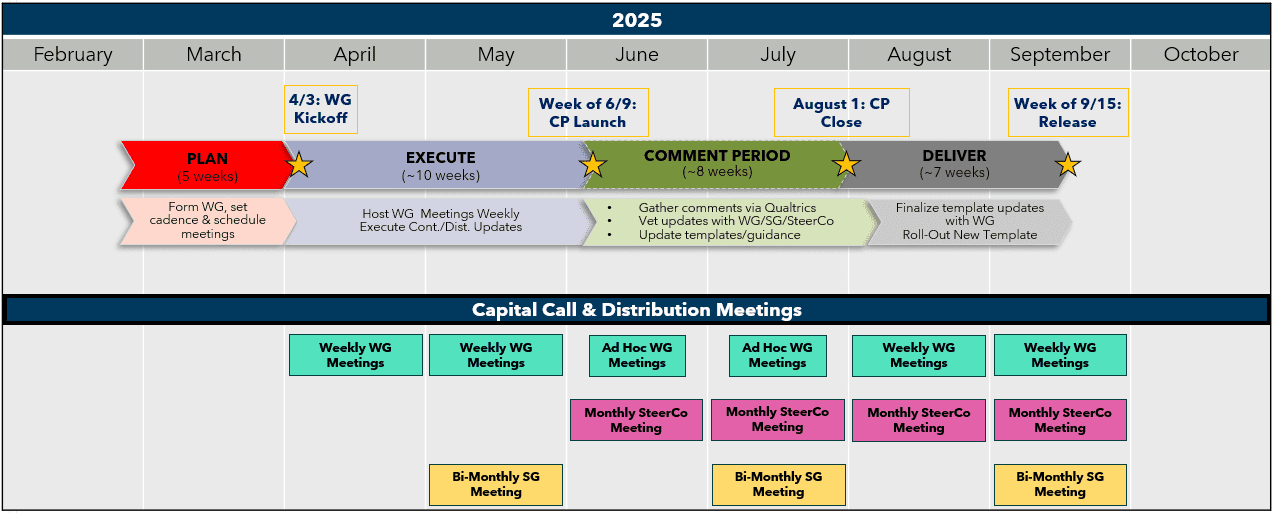

On Tuesday, June 10, the Institutional Limited Partners Association (ILPA) launched a public comment period to solicit feedback on an updated ILPA Capital Call & Distribution Template. The comment period will run for eight weeks through Friday, August 1. Feedback on the updated Template can now be provided via the Qualtrics survey linked below.

Comment period participants will review the new and updated aspects of the Capital Call & Distribution Template, from the revamped Fund- and LP-Level Sections to the new Transaction Table. Additionally, the survey will test structural questions impacting the Template, such as implementation timeline, considerations for smaller managers and application to active funds. This updated Template has been drafted based on several weeks of intensive brainstorming sessions with a dedicated Working Group, which includes representation from LPs, GPs, Fund Administrators and Service Providers from throughout the industry.

Please note that the comment period survey is meant to be completed in connection with reviewing the actual Template available for the comment period. The survey includes visuals from the Template, but to ensure comprehensive review, please be sure to download the Template itself below to reference alongside the survey.

Upon submitting the survey, commenters will receive an automated email confirming receipt of the completed survey. The ILPA team will review and consolidate input, and conduct follow-up conversations as needed. When the comment period concludes on Friday, August 1, the ILPA team will use the consolidated feedback to adjust the Template as needed ahead of rolling out the finalized Template to the industry by mid-to-late September.

Overview (2011 Capital Call & Distribution Template)

As fiduciaries, Limited Partners seek increased transparency and reporting in order to inform and guide their boards, trustees, portfolio managers and risk departments. To serve these various constituencies, investors repeatedly inquire General Partners about their investment activities. The ILPA has been working, in conjunction with GPs and LPs, to develop a set of standardized best practices and reporting templates to improve GP/LP transparency and generate industry efficiencies.

The Capital Call & Distribution Notice Best Practices were established in January 2011.

From the LP’s perspective, capital call & distribution notices (“Notices”) are the initial basis for its monitoring and fiduciary reporting duties. Notices are expected to enhance an LP’s understanding of how capital is being allocated, while allowing a GP to efficiently manage cash flow requirements.

After extensive consultation with GPs, LPs and third-parties, the ILPA developed guidelines for the expected level of content in Notices. To establish consistency in reporting, it also created a Notice template that can be used by the entire industry.

Downloads (2011 Capital Call & Distribution Template)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

From the LP’s perspective, capital call & distribution notices (“Notices”) are the initial basis for its monitoring and fiduciary…

From the LP’s perspective, capital call & distribution notices (“Notices”) are the initial basis for its monitoring and fiduciary…

There’s never been a more exciting time to become an ILPA member

Join ILPA now to connect with a global network of LPs, maximize your performance, and advance your interests through best-in-class education, research, advocacy, and networking.