ILPA Performance Template

The ILPA Performance Template was developed to standardize return calculation methodologies in the private equity industry by creating a framework for capturing performance metrics and corresponding contributions/distributions.

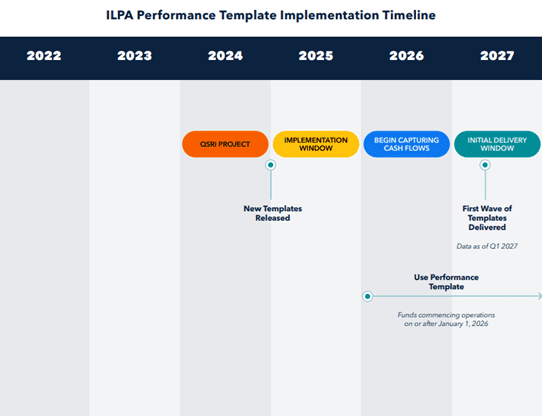

The Performance Template should be used on a go-forward basis for Funds commencing operations on or after January 1, 2026.

About the Template

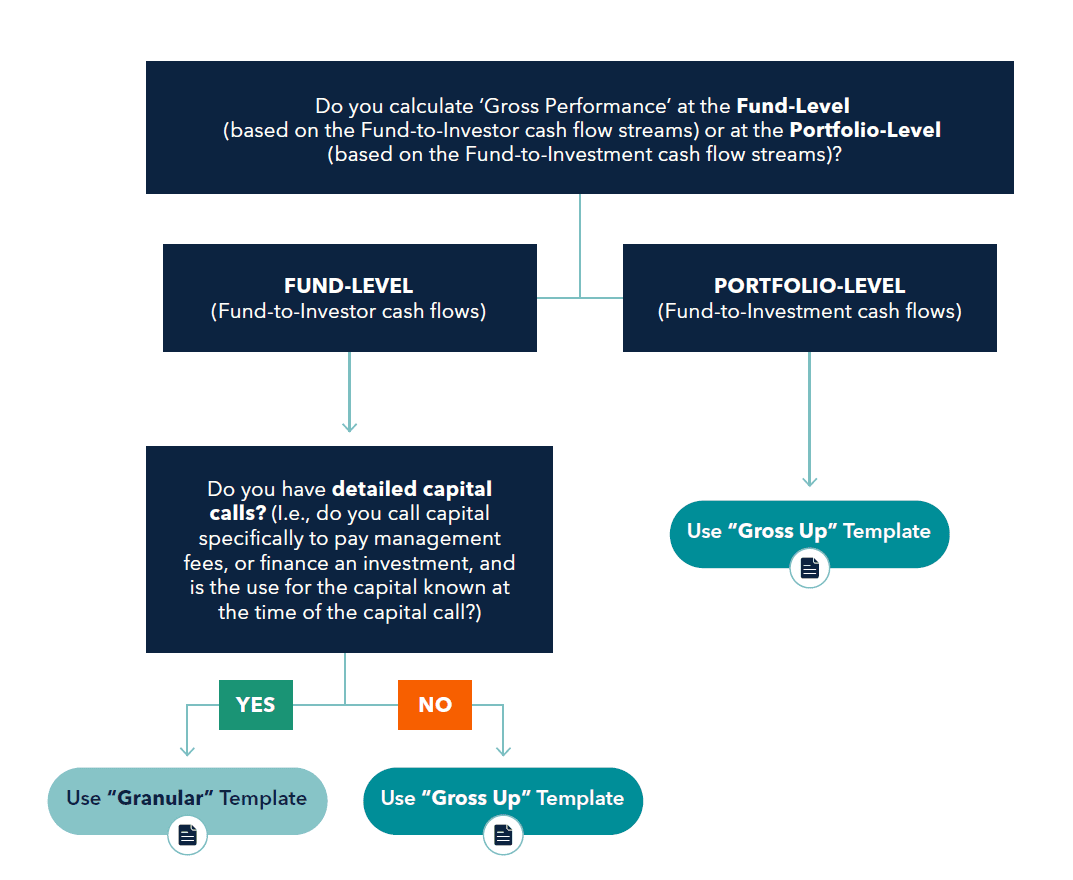

There are two versions of the Performance Template – both display the same fund- and portfolio-level performance metrics and cash flow data; however, the level of details with the transaction types and the calculation methodology used to calculate fund-level gross performance differs. GPs should select the Performance Template that most closely aligns with how they calculate gross performance and call capital.

Some GPs use fund-to-investor cash flows for gross fund-level performance and itemize each capital call (i.e., know at the time of the call if the capital will be used to finance an investment, pay management fees, etc.) – these GPs should use the “Granular Methodology.”

Other GPs use fund-to-investment cash flows for gross fund-level performance and/or do not itemize capital calls and instead gross up cash flows – these GPs should use the “Gross Up Methodology.”

Use the decision tree below to help select the appropriate version of the template for your purposes.

Full Package Download

- Go to ILPA Performance Template – Granular Methodology (v1.1) and Supplemental GuidanceILPA Performance Template – Granular Methodology (v1.1) and Supplemental GuidanceDownload this zipped folder containing all pieces of the template and the supplemental guidance.

- Go to ILPA Performance Template – Gross Up Methodology (v1.1) and Supplemental GuidanceILPA Performance Template – Gross Up Methodology (v1.1) and Supplemental GuidanceDownload this zipped folder containing all pieces of the template and the supplemental guidance.

Templates

- Go to ILPA Performance Template – Granular Methodology (v. 1.1)ILPA Performance Template – Granular Methodology (v. 1.1)The ILPA Performance Template - Granular Methodology was developed to standardize return calculation methodologies in the private equity industry by creating a framework for capturing performance metrics and corresponding contributions/distributions.

- Go to ILPA Performance Template – Gross Up Methodology (v. 1.1)ILPA Performance Template – Gross Up Methodology (v. 1.1)The ILPA Performance Template - Gross Up Methodology was developed to standardize return calculation methodologies in the private equity industry by creating a framework for capturing performance metrics and corresponding contributions/distributions.

Suggested Guidance

- Go to ILPA Performance Template Suggested Guidance – Granular Methodology (v. 1.1)ILPA Performance Template Suggested Guidance – Granular Methodology (v. 1.1)Guidance around the ILPA Performance Template – Granular Methodology.

- Go to ILPA Performance Template Suggested Guidance – Gross Up Methodology (v. 1.1)ILPA Performance Template Suggested Guidance – Gross Up Methodology (v. 1.1)Guidance around the ILPA Performance Template – Gross Up Methodology.

- Go to Combined Overview: ILPA Reporting Template, Performance Template and Capital Call & Distribution TemplateCombined Overview: ILPA Reporting Template, Performance Template and Capital Call & Distribution TemplateCombined overview of the latest ILPA Reporting Template, Performance Template and Capital Call & Distribution Template.

Definitions

- Go to Definitions – Granular MethodologyDefinitions – Granular MethodologyDefinitions contained in the ILPA Performance Template – Granular Methodology.

- Go to Definitions – Gross Up MethodologyDefinitions – Gross Up MethodologyDefinitions contained in the ILPA Performance Template – Gross Up Methodology.

Template Guides

- Go to Template Guides – Granular MethodologyTemplate Guides – Granular MethodologyDetailed guidance pointing to specific aspects of the Granular Performance Template and the fund-level transaction types found within the Template.

- Go to Template Guides – Gross Up MethodologyTemplate Guides – Gross Up MethodologyDetailed guidance pointing to specific aspects of the Gross Up Performance Template and the fund-level transaction types found within the Template.

Sample Templates & Other Examples

- Go to Sample Template & Other Examples – Granular MethodologySample Template & Other Examples – Granular MethodologyA sample completed ILPA Performance Template – Granular Methodology and sample usage of methodology-specific transaction types.

- Go to Sample Template & Other Examples – Gross Up MethodologySample Template & Other Examples – Gross Up MethodologyA sample completed ILPA Performance Template – Gross Up Methodology and sample usage of methodology-specific transaction types.

- Go to Methodology Comparison - Granular and Gross Up MethodologyMethodology Comparison - Granular and Gross Up MethodologyLine-by-line comparison of the Granular and Gross Up fund-level transaction types and the treatment of each.

Video Walkthroughs

- Go to Introduction to the New ILPA Performance Templates Introduction to the New ILPA Performance TemplatesA quick video walkthrough of the main elements of both of the ILPA Performance Templates, and the differences between the two. (5 minutes)

- Go to A Deep Dive into the new ILPA Performance TemplatesA Deep Dive into the new ILPA Performance TemplatesA detailed look into each of the ILPA Performance Templates, with special attention paid to the defining features of each, and time spent walking through sample cash flow mapping methodologies. (15 minutes)

Webcasts

- Go to Jumpstart Your Understanding of the New ILPA Reporting StandardsJumpstart Your Understanding of the New ILPA Reporting StandardsILPA and a panel of experts talk through the next evolution of ILPA reporting standards – the just-released updated ILPA Reporting Template and the new ILPA Performance Templates. (February 4, 2025)

- Go to ILPA Quarterly Reporting Standards Initiative – Q+A Session for Industry ILPA Quarterly Reporting Standards Initiative – Q+A Session for IndustryCommon questions received as the ILPA Reporting Template and ILPA Performance Template were being developed. (October 3, 2024)

- Go to Quarterly Reporting Standards Initiative and Open Public Comment PeriodQuarterly Reporting Standards Initiative and Open Public Comment PeriodAbout the Quarterly Reporting Standards Initiative and public comment period that helped shape the ILPA Reporting Template and ILPA Performance Template. (September 24, 2024)

For questions on the latest Reporting Template, Performance Template or Capital Call & Distribution Template, please contact templatesupport@ilpa.org.